Disclosure: The opinions expressed are solely those of Anthony Phillips. Luxury Real Estate Advisors, NAR, or any named defendants have not been consulted or provided permission for publication.

That said, these cases are garbage.

Burnett v. The National Association Of Realtors | Regurgitation Of Defective Claims

Far from presenting original arguments, Burnett v. The National Association Of Realtors merely echoes the allegations forwarded in other legally deficient lawsuits, which appear to cite “consumer advocate” Stephen Brobeck, subsequently parrotted by Burnett’s expert witness Dr. Craig Schulman. Moreover, the choice to lodge the case in Missouri introduces further counterarguments.

Claims Of Damages Based On Comparable Foreign Markets

Instead of using established economic measures like average home values, currency conversion rates, and additional costs imposed on buyers that significantly influence transaction economics, Burnett bases his damage claims purely on foreign market commission “rates.” The complaint cites a 2002 study proclaiming, “Worldwide, we observe significantly lower residential commission rates in many other highly industrialized nations, including the United Kingdom (UK), Hong Kong, Ireland, Singapore, Australia, and New Zealand… In the UK, the [total] commission rates average less than 2%… In New Zealand and South Africa, [total] commission rates average 3.14%.“ “In Singapore, the [total] commission rates also tend to hover around 3%.”

Singapore vs. Missouri

Burnett’s intent to conflate fees and rates is misleading and deceptive. To illustrate this point, let us consider Singapore and claims that brokerage fees are significantly lower than in the US. The average value of a cluster house (townhome) in Singapore is approximately $2,504,215 when converted to US dollars. Based on available data for 2020, Missouri’s average home value was approximately $210,000. A 3% commission in Singapore would yield a $75,126 fee, while a 6% commission in Missouri would result in a $12,600 fee.

Even if Realtors increased their rates to match the suspiciously similar average rate of 33% imposed by contingency-based law firms, the average fee is $69,300, which falls short of average selling fees in Singapore.

Alternative Brokerage Models | The Solution To Replace Antiquated Agents

Anti-Realtor propagandists proclaim that innovative brokerage models will eliminate two-sided commissions, and buyer rebates solve the dilemma of buyers subjected to non-negotiable fees.

This question has been asked and answered.

Entities like Zillow introduced the iBuying system as an antidote to the age-old dual-commission models, pitching the idea that sellers could deal directly with iBuying companies. This was thought to streamline the process, reduce fees, and provide better profits for users. Yet, in practice, the iBuying model was far from a success story. Instead of lowered costs, consumers were hit with higher fees, and iBuying agencies struggled to turn a profit, even in a favorable market. The model’s shortcomings were so apparent that giants like Zillow and Redfin retreated from this niche, while competitors like OpenDoor and Offerpad found themselves reducing their fees to remain competitive with classic Realtor systems.

The Federal Trade Commission’s (FTC) stance against OpenDoor further underscores the limitations of the iBuying framework. The FTC accused OpenDoor of conveying false promises to potential home sellers, insinuating they’d make more by selling to OpenDoor than they would in the open market. As it stands, the FTC claims OpenDoor’s pitches were misleading, resulting in most sellers receiving significantly less than they might have in a traditional sale. OpenDoor’s updated statement acknowledges, “*From September 30, 2020, our service charge will not exceed 5%. Charges are subject to revision and have historically been as high as 14%.” Similarly, Offerpad’s Express Cash Offer, touted as a way to skip dual realty commissions, still imposes a 6% fee, surpassing the National Association of Realtors (NAR) average.

The conclusion drawn is that both OpenDoor and OfferPad slashed their fees to compete within the competitive landscape offered by the MLS.

Moreover, the idea of offering commission rebates to buyers is often presented as a panacea to alleged issues with fixed commissions for buyer agents. Redfin is frequently highlighted as a shining example.

Based on the details from Redfin’s March 2023 Form 10-Q, the company chose to end commission refunds across all its markets following a successful test phase, averaging a refund of $1,336 per deal in 2022. Even with Redfin’s operations in premium property sectors and providing their agents with state-of-the-art tech packages worth $25,000 annually (which enables Redfin agents to earn twice as much as their traditional counterparts), it’s surprising that Redfin refrains from offering even modest credits to its clients.

Here’s a thought: Let’s consider re-evaluating the purported high fees of traditional agents once the proptech brokerage industry not only aligns its services with those of full-service agents but also offers discounts and attains profitability.

Adversarial Transactions

Contrary to the assertion made by Plaintiffs that real estate transactions are adversarial, leading to the ineffectiveness of sellers contributing to buyer agent’s commissions, we propose a different perspective. Real estate transactions, by nature, are fundamentally collaborative. All parties—buyers, sellers, buyer’s agents, and seller’s agents—are united in pursuing the same outcome: to finalize a transaction under mutually agreed-upon pricing and terms. Redfin agrees. A study by Redfin published on January 5, 2023, titled “A Record Share of Home Sellers Are Giving Concessions to Buyers,” announced that “Home sellers gave concessions to buyers in 41.9% of home sales in the fourth quarter—the highest share of any three-month period in Redfin’s records, which date back to July 2020.“

Assertions Related To Buyers Agents

Fee Concealment Schemes

It’s intriguing that attorneys quick to pursue claims related to real estate commission rates of around 5% don’t bat an eye at the standard 33% contingency fees often imposed by contingency-based law firms. What’s more, while they criticize any lack of clarity regarding fees on real estate agents websites, many of these law firms and their affiliates conveniently overlook the omission of their own fees on their platforms.

Apparently, consumers learn about legal fees by inquiring, similar to real estate.

Standard Commission Claims Fail

Claims of a “standard” fails; Clever Real Estate claims that buyer’s agent commission ranges from 2.19% to 3.17%. Cohen Milstein, attorneys for the Plaintiff in Moehrl v. National Association of Realtors et al., appear to collect up to 40% of a judgment. Law firms that impose fees often exceeding 33% likely deem a ~1% reduction in fees (commissions) as insignificant. The variance related to the spectrum of agent fees equates to a 33.51% differential.

Who Pays The Commision? Buyer or Seller?

The question of who bears the commission cost in real estate transactions—buyer or seller—is intricate. While the Consumer Federation of America hasn’t pinpointed a definitive stance, the debate is evident in various class-action lawsuits. The Department of Justice, along with some litigants, believe the buyer foots the bill since the commission is embedded in the purchase price. Conversely, others, including Judge Andrea Wood, argue that the seller covers the commission, given that it’s determined in the listing agreement and taken from the sale earnings. The truth probably straddles both perspectives. Both parties influence the commission through their negotiations, pricing choices, and commission agreements, underscoring the multifaceted nature of real estate dealings that are often diluted in mainstream conversations.

Muddying Waters

Plaintiffs seem to add unfounded claims, suggesting a more predatory system. However, such assertions cast doubts on their grasp of the legal intricacies.

- They argue the Buyer Broker Commission Rule mandates standard compensation, irrespective of an agent’s experience. However, commissions are determined by a Buyer’s Agent’s capacity to execute a sale at the Seller’s price and conditions. It’s about successful facilitation, not tenure.

- They assert Sellers can’t independently reduce commissions. Remember, neither party can single-handedly modify a jointly signed agreement. Commissions, set during the listing phase, require mutual consent for any adjustments.

- They suggest commissions are non-negotiable, pointing to rules against negotiation within purchase offers. This misses the potential for tortious interference. While direct negotiation in offers can lead to legal repercussions, parties can negotiate outside this, including through commission rebates from certain brokerages.

Claims Of A Diminishing Role Of Buyers Agents | Advancements In Technology

Plaintiffs posit that technological progress “should have” resulted in reduced buyer agent fees as buyers typically locate their desired property online before reaching out to an agent.

This implies a streamlined process involving just a single tour, escrow, and closing.

OpenDoor educates the Plaintiffs by publishing a study revealing significant efforts by buyer agents.

“Want to Buy Your First Home? Get Ready to Tour 15 Houses and Make at Least 5 Offers.”

“A new report from Opendoor, a residential real estate platform for buyers and sellers, underscores the lengths first-time homebuyers have been going to find a house.” “The company commissioned a nationally representative survey of 1,000 first-time homebuyers, and spoiler alert: They’re putting in tons of time and energy” “THE HOMEBUYING HUSTLE DOESN’T STOP AFTER REFRESHING ZILLOW A BUNCH OF TIMES. Finding a worthwhile listing is merely the first of many steps, likely laden with disappointment for first-timers.” “Next comes the logistics of viewing the homes. The average first-time buyer toured 15 properties — virtually or in-person — AND 33% OF RESPONDENTS TOURED 20 OR MORE, ACCORDING TO THE REPORT” “Rejection shouldn’t only be expected, it’s all but guaranteed. Almost every first-time homebuyer that Opendoor surveyed said they lost out on a property that they were interested in before finally finding their current one — 98% overall, and 99% for millennials.”

Incapable of Innovation

Moreover, a study cited by Plaintiffs infers that traditional real estate firms lack the competency to compete with proptech start-ups, stating: “Technology innovation has occurred alarmingly rapidly, but brokerage companies aren’t technology companies, nor are they structured to grow at this rate. Even many of the large brokerage companies and national franchises, with more capital than most in the industry, are unable or unwilling to invest the financial and human resources needed to compete with publicly funded technology.”

This claim was startlingly shortsighted and, frankly, negligent in its oversimplification. It displays a total disregard for the dynamic, adaptable, and entrepreneurial nature of the real estate agent’s role and the brokerage industry at large. The claim ignores real estate agents’ individual agency and technological prowess, reducing them to mere functionaries within a larger system.

Traditional real estate firms have consistently weathered both favorable and unfavorable markets, unlike proptech firms, whose carcasses litter the real estate landscape.

Listing Concealment | Steering

The crux of the commission concealment/steering claim seems to be based on a single MLS platform that may have included commissions as one of many filters for real estate listings. However, the Plaintiffs conveniently fail to mention that these same MLS entities syndicate to national portals like Zillow, which collectively receive around 400 million monthly visitors.

Portals do not filter or conceal properties based on commissions. Steering fails.

Missouri Consumers | Inferences Of Incompetency

The Phillips team categorically condemns any suggestion that the citizens of Missouri cannot operate a search engine, thus incapable of gaining insight on commission structures. In a comprehensive analysis of online search behaviors, the 30-day auto-suggest data from AnswerTheWeb via Google revealed a significant number of displays, 4,400 to be precise, related to “real estate commission Missouri.” The number of home sales in Missouri amounted to only 7,312 in May 2023. The data illustrates engagement by Missouri consumers in seeking information about commission structures, signaling their understanding and interest in these matters. Furthermore, this data solely represents Google’s search metrics, omitting other prominent search engines like Bing, further substantiating the argument that consumers are proactively educating themselves on real estate commission structures and their ability to negotiate commissions.

When probing “are real estate commissions negotiable” on search engines, most leading results from platforms like Upnest, Bankrate, and Clever Real Estate provide guidance on bargaining for lower commissions. Notably, even NAR-affiliated Realtor.com confirms, “Commissions are always negotiable.”

Plaintiff’s Expert Witness | Dr. Craig Schulman | Berkeley Research Group

The Plaintiff’s claims of monetary damages and antitrust accusations appear to rely on testimony by Dr. Craig Schulman from the Berkely Research Group (BRG.)

Apparently, Schulman’s partners at BRG did not get the memo.

David Eisenstadt, managing director at Berkeley Research Group and a former senior economist at the Justice Department’s Antitrust Division, appears to disagree with Schulman, contributing to a Business Insider article published on June 26, 2023. A real estate attorney shared Eisenstadt’s opinion and contributed to the article.

Eisenstadt: “But a victory for the plaintiffs is far from guaranteed, some experts say. Since the NAR doesn’t mandate that brokers representing the seller promise a specific amount to their buyer-agent counterparts, the plaintiffs will have to prove that requiring any compensation at all hurts sellers, David Eisenstadt, a managing director at Berkeley Research Group and a former senior economist at the Justice Department’s Antitrust Division, told me. The defendants could then argue something like this: If a seller is able to offer a commission of as little as $1, that’s basically the same as offering zero dollars, so that requirement really isn’t that onerous at all. The defense could also argue that sellers should pay the buyer agent’s commission because they actually benefit the most from their service, Eisenstadt said — namely, bringing forth a buyer who’s willing to shell out hundreds of thousands of dollars for their home.”

Moreover, “There are really strong efficiency reasons for sellers to pay the buyer-broker commission at settlement, rather than the buyer,” Eisenstadt said.

Billions to Bust | Brobeck | Brambila-Inman News

On July 10, 2023, Andrea V. Brambila, Deputy Editor at Inman News, published an article titled “Marginal agents’ with fewer sales now claim quarter of commissions.” This article cites a study by Brobeck titled “Too Many Real Estate Agents For Too Few Home Sales: New CFA Report Documents the Costs to Industry and to Consumers.”

Brobecks study and Brambila’s article were published on the same day. This suggests collusion.

It appears that Brambila and Brobeck, by publishing these studies, intended to bolster the prevailing adverse depiction of traditional real estate agents by introducing a new supposed issue of having an excess of agents.

Brobeck’s study abandoned his failed claims that Realtors charge up to 3x more than comparable foreign markets and now proclaims notably that the “RELATIVELY LOW INCOMES OF MANY FULL-TIME AGENTS” result in a “MEDIAN NET INCOME OF ALL SALES AGENTS” amounting to “$25,000.”

Such an annual income, equating to $12.35 per hour for a full-time worker, falls short of meeting the minimum wage standards in many states.

Brobeck and Brambila’s work is frequently referenced in class-action lawsuits. Therefore, on behalf of traditional real estate professionals, we express deep gratitude for this significant misstep.

Clear Co-Operation | Hail Mary

Plaintiffs, including The PLS and Top Agent Network, are challenging NAR’s Clear Co-Op policy, alleging anti-trust violations and suggesting that non-compliance could imperil brokerages. The PLS’s founder is believed to be also behind The Agency.

On August 10, 2023, a discussion panel by Inman on the Clear-Co-Op featured Redfin’s Joe Rath and NextHome CEO James Dwiggins. Dwiggins indicated that pocket listings have grown since the policy’s implementation. He noted that Redfin might pursue exclusive listings as the industry appears to overlook NAR’s directive. Dwiggins, of NextHome, criticized pocket listings and argued that those opposing Clear Cooperation are mainly looking to benefit their brokerages.

Pocket Listings: Potential for Misleading Practices

A study by The Washington Post highlighted the issue of pocket listings. The data indicates that with today’s transparent digital platforms, buyers can easily access information like a property’s listing history, past selling prices, and price reductions. Such details can hint to buyers if a home might have been overpriced initially. However, there’s a concern that agents dealing with pocket listings might not adhere to disclosure obligations, such as NRS 645.252, which mandates agents to disclose material facts about a property as soon as feasible. This lack of transparency may mislead buyers into paying higher prices. The industry might soon witness an uptick in class-action lawsuits from buyers who believe they were deprived of essential details, causing them to pay more than necessary.

Law firms like Cohen Milstein might step up to represent these buyers.

Revolving Door Of Plaintiffs | Concerns Of Judicial Bias | Probable Associations With Plaintiff and Class Counsel

The Burnett case was formally titled Sitzer v. National Association of Realtors. As with other cases, lead plaintiffs vanish and are replaced by new lead plaintiffs. Where is Sitzer? He was terminated on May 9th, 2022. Or the original plaintiff, Amy Winger, who was terminated on May 6th, 2022. In our view, original plaintiffs are substituted with new plaintiffs who may perform better under intense cross-examination.

Burnett is, presumably, attempting to avoid disastrous testimony similar to Illinois Plaintiff Moehrl, who admitted during depositions that the “buyer agent did not say his services were free” and “stated that he would expect to use a buyer broker in future home purchases, just as he did in his purchase of his prior homes.” Finally, “While none of the named Plaintiffs could recall having difficulty coming up with a down payment, they did understand that other home buyers might and that those HOME BUYERS MIGHT BE BETTER OFF UNDER THE CURRENT SYSTEM.”

According to VA loan regulations, Veterans are not allowed to pay certain closing costs, including agent commissions. As stated in the VA loan guidelines, “The VA prohibits Veteran buyers from paying agent commissions.”

Perhaps Plaintiff Moehrl had a realization that hindering the homeownership path for low-income families and elite military units like Seal Team Six might not be well-received.

Plaintiffs 2.0 | Conflicts | Presumption Of Judicial Bias | Missouri Association Of Trial Attorneys

Shelly Dreyer, a substitute lead Plaintiff, is not expected to weaken the entire set of Plaintiff’s claims in Missouri. It’s noteworthy that Dreyer holds a significant position as the current Vice President and is potentially in line to be the next President of the Missouri Bar Association. In addition, she is a member of the executive committee and is a part of the Board Of Governors at the Missouri Association Of Trial Attorneys. Notably, two of her attorneys litigating this case, Brandon Boulware and Matthew L. Dameron, serve alongside her on the board.

But wait, there is more.

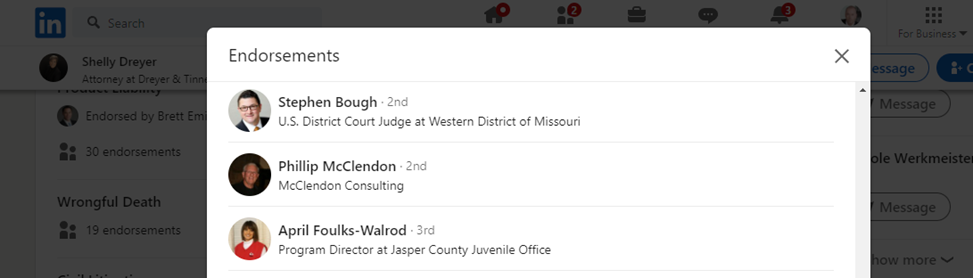

Judge Stephen Rogers Bough cites current affiliations on Ballotpedia.org, namely 2001-Present: Board of Governors, Missouri Association of Trial Attorneys.

We are far from legal scholars; however, it appears that Judge Bough, Plaintiff Dreyer, Plaintiffs Attorneys, Brandon Boulware, and Matthew L. Dameron are materially connected, and as VP of the Missouri Bar, Dreyer may have regulatory/ethical oversight over Judge Bough.

Judge Bough even publicly endorsed VP and Plaintiff Shelly Dreyer.

Rule Of Reason v. Per Se

Under the umbrella of antitrust analysis, the legal framework utilizes the Rule of Reason and the Per Se rule to evaluate the legality of agreements that could potentially limit competition.

The Rule of Reason requires a thorough evaluation of an agreement’s advantages and disadvantages to determine its antitrust compliance. For example, in the Christopher Moehrl’s case, despite paying a significant buyer-broker commission during his house sale, he experienced net savings in his subsequent house purchase, suggesting the Cooperative Compensation Rule benefited him.

Conversely, the Per Se rule assumes certain agreements automatically violate antitrust laws, disregarding other considerations like business motivations or competitive gains. These cases can be challenging to defend as they often overlook crucial factors.

Judge Bough chose to use the “per se” standard, a choice that appears to deviate from the decisions of other judges in comparable cases. Furthermore, as the Burnett case is the first heading to trial, its outcomes could establish a precedent.

Even a prolific hater and attorney recently wrote: “Per Se Liability! There was a moment when I had to go back and re-read the section twice, then again, to make sure that I was reading things correctly.” And: “Basically, if you get the per se liability treatment for whatever you’re accused of doing, you’re screwed.”

The American Bar Association’s Model Code of Judicial Conduct states: “A judge shall uphold and promote the independence, integrity, and impartiality of the judiciary, and shall avoid impropriety and the appearance of impropriety.”

Judge Bough’s recusal is warranted.

The End Of Baseless Lawsuits

The plaintiffs’ case foundation appears to be on shaky ground. In a Massachusetts case, even though they represented a vast class of sellers dating back to 1997, the counsel sought a mere $3,000,000 settlement with MLS PIN. The overseeing judge, Judge Saris, expressed skepticism about the proposed settlement while recognizing positive changes in a commission rule.

Judge Saris remarked, “In my 30 years, I’ve not encountered such a settlement agreement.” She noted the absence of monetary benefits for the class members but highlighted that the class-action attorneys’ expenses are fully covered. Moreover, these lawyers are set to receive an indefinite litigation fund for the years to come.

What once seemed like aspirations for a massive judgment now appears to lean more towards securing attorneys’ fees. After all, they have mouths to feed.

Realtor Commission Lawsuit Update: Key Takeaways from Recent Revelations

- Repetitive Claims in Burnett v. The National Association Of Realtors: The Burnett lawsuit against The National Association of Realtors is a reiteration of allegations seen in other legally flawed lawsuits. The foundation of these claims seems to borrow heavily from “consumer advocate” Stephen Brobeck and Dr. Craig Schulman, who serves as Burnett’s expert witness.

- Comparing Global Commission Rates: The lawsuit draws attention to lower residential commission rates in countries like the UK, New Zealand, and Singapore. However, a closer examination, especially of Singapore’s real estate landscape, highlights the pitfalls of such simplistic comparisons.

- iBuying Systems – More Hype Than Reality: Despite the initial enthusiasm, the iBuying model proposed by companies like Zillow and OpenDoor didn’t offer the expected advantages. Instead, consumers faced higher fees, and even powerhouse platforms like Zillow backed out. Moreover, the Federal Trade Commission’s recent issues with OpenDoor further challenge the efficacy of such models.

- The Myth of Adversarial Real Estate Transactions: Contrary to the plaintiffs’ claims, real estate transactions are inherently cooperative. All parties involved, from buyers and sellers to agents, aim for a smooth transaction. As evidence, Redfin’s study shows that a record percentage of home sellers are willing to make concessions to buyers.

- Technological Advances and Buyer Agents: While plaintiffs argue that technological advancements should reduce buyer agent fees, Opendoor’s report emphasizes the tremendous effort buyer agents still put into each transaction.

- Commission Concealment Accusations: The case’s focus on potential commission concealment, based on a single MLS platform, overlooks the vast reach of national portals like Zillow, which serve millions of visitors without any commission-based filters.

- Missouri Consumers – Competent and Informed: Any insinuation that Missouri citizens lack the capability to research commission structures is unfounded. Evidence suggests that the majority of these consumers actively seek information, indicating a keen awareness of the real estate landscape.

- Disagreements Amongst Experts: Dr. Craig Schulman’s stance in the lawsuit seems to clash with opinions from other experts in his field. Notably, David Eisenstadt from the same Berkeley Research Group offers a contrasting viewpoint, stressing the logistical reasons for sellers to cover buyer-broker commissions.

- Controversial Publications: A recent publication by Inman News and a study by Brobeck seem synchronized in their release, suggesting possible collaboration. Interestingly, Brobeck’s study actually highlights the modest earnings of many real estate agents, challenging the narrative that agents are overcompensated.

In conclusion, the complexities of real estate commissions and the dynamics of the industry aren’t easily reduced to simple percentages. It’s essential to consider the broader context and the myriad factors influencing transaction economics when assessing the merit of claims in such lawsuits.

Author Anthony Phillips

Anthony Phillips, co-founder of Luxury Real Estate Advisors, is renowned in the luxury real estate market of Las Vegas, providing top-tier services to global clients, including private equity firms. In addition to leading 12 Las Vegas HOA Boards, his performance at premier locations earned him a spot in MGM Resorts International’s Elite Developer Circle. As an authoritative voice in real estate, his views have appeared in publications like Forbes and American Genius. Before his current venture, he was an executive at Del Webb, aiding in the construction of over 11,000 homes.

Phillips continually enhances his expertise through Executive Education programs at Cornell University and MIT. He hails from the influential Phillips family of New England, known for their varied contributions to law, academia, business, politics, and consumer rights.

Related Opinions | The Phillips Report

The Phillips Report: A Critical Examination And Rebuttal Of Claims Asserted In Commission Lawsuits Vs. The National Association Of Realtors

Realtor Commission Lawsuit Update | US District Court in Massachusetts