Disclaimer: The views expressed here are exclusively those of Anthony Phillips. These opinions are independent and have not been endorsed or authorized by any other agent, brokerage, entity, or association. While Phillips maintains a neutral stance towards The National Association of Realtors, he finds the continuous disparagement of traditional real estate agents through coordinated misinformation campaigns wholly intolerable.

INTRODUCTION

The challenges facing the National Association of Realtors (NAR) and legacy real estate agents signify a strategic effort to disrupt traditional real estate norms. There is a conspiracy of Proptech companies, backed by Wall Street, that retain so-called “experts” to publish complex econometric studies to confuse yet corroborate and promulgate anti-agent narratives at scale. Per Restoration of America: “In the broader scheme of things, these moves against NAR are arrows in the quiver of the Democratic White House regarding policy pushes on both independent contractors and antitrust.”

This movement appears less about market equity and shifting industry control and regulation.

PROPTECH PROPAGANDISTS

The residential real estate landscape has been aggressively overtaken by PropTech firms, signaling a concerning shift in the sector. Often prematurely labeled as “visionaries” merely for possessing an Ivy League degree, the founders of these firms frequently receive undue acclaim despite lacking substantial proof of profitability, such as even a single quarter of net income. This wave of PropTech and its marketing sharply contrasts with the pre-PropTech era, where traditional agents built their client base on demonstrable skills and a proven success record. In stark deviation from these values, PropTech firms engage in ruthless competition, unjustly portraying traditional agents as outdated remnants of the past. They misrepresent these agents’ abilities and grossly overstate the fees in conventional real estate transactions.

CITED | INDUSTRY PARTICIPANT | REDFIN

From my perspective, brokerages, most critical of high fees, often struggle to reach profitability despite substantial investments. A notable example is Glen Kelman of Redfin. Kelman seems to be positioning himself as a paragon of industry ethics for other brokerages to emulate. He has made a public spectacle of cutting ties with NAR, prominently criticizing the alleged misconduct of its past leadership in the media, and emphatically announced the termination of their relationship with a decisive “enough is enough.” Kelman’s inspirational sermons are undermined by Redfin’s Better Business Bureau rating of an F, and complaints believed to be published by current or former Redfin employees, one of which alleged “hidden discrimination and racism.”

ALLEGATIONS OF EXCESSIVE COMPENSATION | THE 6% BENCHMARK FALLACY

Kellman is vocal that 6% commissions should not exist. However, in 2022, Redfin settled a lawsuit alleging redlining and discrimination. In their response, Redfin stated, “Our service decisions are not influenced by race or neighborhood demographics. The sole criterion for these decisions is the home price, as it directly correlates with the fees we generate.” And “THE CHALLENGE IS THAT WE DON’T KNOW HOW TO SELL THE LOWEST-PRICED HOMES WHILE PAYING OUR AGENTS AND OTHER STAFF A LIVING WAGE, WITH HEALTH INSURANCE AND OTHER BENEFITS,” HE ADDED. “THIS IS WHY REDFIN AGENTS AREN’T ALWAYS IN LOW-PRICED NEIGHBORHOODS.”

To the residents of Joplin, Missouri, Redfin’s refusal to offer a full range of services in Joplin is not rooted in racism; instead, it is because you are too poor.

REDFIN REBATES

Redfin reported that their agents earned a median annual income of $112,200 in 2020, more than double the median income of $49,700 for traditional real estate agents. Despite these higher earnings, Redfin discontinued its buyer rebate program, which was selectively offered in certain markets and had provided an average of nearly $1,400 per transaction to buyers.

REDFIN | FEE CLARITY

Kelman is a staunch advocate for commission clarity and transparency. Per Redfin, “*Fees are subject to change; minimums apply. The buyer’s agent fee is not included; e.g., if the Buyer’s agent fee is 2.5%, the seller will pay a total fee of 3.5%. Listing fee increased by 1% of sale price if Buyer is unrepresented. Sell for a 1% listing fee only if you also buy with Redfin within 365 days of closing on your Redfin listing. We will charge a 1.5% listing fee then send you a check for the 0.5% difference after you buy your next home with us. Learn more.”

Redfin’s pricing structure, riddled with complex contingencies and opaque conditions, hardly offers the straightforward, consumer-friendly approach it claims. The fine print reveals a labyrinth of conditions: fees that change based on multiple factors, increased listing fees under certain circumstances, and a convoluted rebate system contingent on further transactions with Redfin.

ALT-BROKERAGE MODELS | ELIMINATING COMMISSIONS | PROPTECH’S PIPE DREAM

The iBuying service model, once hailed as a revolutionary solution to combat the alleged excessive commissions of the ‘Realtor Cartel,’ has spectacularly failed to deliver on its promises. Far from being the panacea for overpriced commissions, these services have fallen short of significantly impacting the issue, highlighting a profound disconnect between their ambitious claims and the reality of their market performance.

iBuying firms spectacular failures resulted in:

-Zillow ceased iBuying services

-Redfin ceased iBuying services

-OfferPad implemented a 15-to-1 reverse stock split to avoid being delisted from the index after its share price fell below $1 per share.

-OpenDoor’s stock peaked at $34.59, plummeting to $3.62.

Allegations critical of OpenDoor business practices resulted in a federal investigation into OpenDoor’s practices, which concluded that “Opendoor promised to revolutionize the real estate market but built its business using old-fashioned deception about how much consumers could earn from selling their homes on the platform” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “There is nothing innovative about cheating consumers.” Moreover, “Opendoor’s marketing materials included charts comparing consumers’ net proceeds from selling to Opendoor versus on the market. Those charts almost always showed that consumers would make thousands of dollars more by selling to Opendoor. IN FACT, THE COMPLAINT STATES, THE VAST MAJORITY OF CONSUMERS WHO SOLD TO OPENDOOR ACTUALLY LOST THOUSANDS OF DOLLARS COMPARED WITH SELLING ON THE TRADITIONAL MARKET, BECAUSE THE COMPANY’S OFFERS HAVE BEEN BELOW MARKET VALUE ON AVERAGE AND ITS COSTS HAVE BEEN HIGHER THAN WHAT CONSUMERS TYPICALLY PAY WHEN USING A TRADITIONAL REALTOR.”

It’s important to highlight that the Federal Trade Commission’s (FTC) lawsuit against OpenDoor takes into account several key factors, such as “consumers’ net proceeds,” “costs,” and particularly the substantial financial losses experienced by most consumers who sold their properties to OpenDoor. This points to the real financial impacts on consumers. In contrast, the analysis by the plaintiff’s expert overlooks crucial elements beyond just the “rates” cited by their economist.

ALLEGATION: NAR POLICIES CREATE UNSURMOUNTABLE BARRIERS TO ENTRY

To salvage reputations, PropTech CEOs often claim NAR’s “anti-competitive” policies are the sole reason their firms failed. Pundits highlight the decaying carcasses of Rex Homes and PurpleBricks as examples.

PurpleBricks US & AU

PurpleBricks’ catastrophic failure in the US and Australia is a textbook case of corporate incompetence. Their blunder began with mindlessly transplanting the UK model into vastly different markets. Financially, their strategy was akin to setting money on fire, with a ludicrous $20 million blown on advertising against meager earnings, resulting in a laughable cost-revenue ratio. The non-refundable fee model, thriving in the UK, was disastrously out of sync with US norms, alienating customers who prefer success-based commissions. This led to widespread dissatisfaction, as clients resented paying fees for unsuccessful transactions.

REX HOMES

REX Homes’ downfall is a stark illustration of catastrophic business strategy and gross mismanagement in the real estate sector. Their collapse can be attributed to a series of blunders and miscalculations. Firstly, their marketing was a facade of innovation; they leaned heavily on platforms like Zillow, contradicting their narrative of technological disruption. This dependency unmasked their claims as nothing but a veneer of progressiveness. Furthermore, their strategy was rife with hypocrisy. After initially denouncing MLS systems, their eventual pivot to join these platforms exposed a lack of strategic direction and a profound irony in their approach.

The operational and financial aspects of their business were handled with equal ineptitude. Sudden layoffs and office shutdowns painted a picture of internal chaos, while their mishandling of private funding reflected a severe lack of financial acumen. But perhaps the most telling was the failure in leadership and organizational structure.

An alleged former Rex published an opinion online stating, “CEO and the Cofounder don’t know anything about running start-ups and are both panicking but telling everyone that things are ok _some investors refused to fund the company, so they are not even paying their bills and the CEO and his wife are now running things which is weird CEO and cofounder are asking employees to pump up numbers so that they can try pretend things are okay when they’re talking to their investors, this is making everyone uncomfortable. The best people have mostly left, and even senior people resigned after they saw what was happening _They don’t have proper leaders anymore in marketing, data science, finance, HR, and other teams are low on people.”

EXPERT WITNESS INTEGRITY | ETHICAL DUTIES

Ethical Obligations: “Expert witnesses must uphold principles of objectivity, independence, honesty, integrity, and professional competence. THIS DUTY IS PARAMOUNT AND OVERRIDES ANY OBLIGATION TO THE CLIENT. IN LINE WITH THIS DUTY, IT IS CRUCIAL THAT EVIDENCE PRESENTED TO THE COURT, AND PARTICULARLY TO A JURY, IS CLEAR, RELEVANT, AND FREE FROM ANY FORM OF CONFUSION OR AMBIGUITY. THE PURPOSE OF EVIDENCE IS TO ILLUMINATE THE FACTS, NOT TO OBSCURE THEM.”

The plaintiffs’ strategy in utilizing convoluted econometric analysis models appears to be a calculated move to perplex and mislead rather than to clarify the issues at hand.

The FTC appears to favor the application of KISS economic methodologies over the complex econometric analysis applied by Plaintiff’s economic experts. Per the FTC: “The key decision makers at the FTC (and DOJ), the courts, and their legal staffs are generally not economists or econometricians. Our experience at the FTC and as litigation economists indicate that if the legal staff and decision-makers do not have a basic understanding of the economic modeling and econometric analysis in a specific matter, and if they do not see a sufficient link between that analysis and its conclusions with the other evidence, they are not likely to give that econometric analysis much weight. When this occurs, it is a failure of the economists, who should ground firmly the econometric analysis in the institutional setting and facts of the case.”

PLAINTIFF’S ECONOMIC EXPERTS | AN INTRODUCTION TO ABSURDITY

SITZER | BURNETT | ECONOMIC EXPERT | DR. CRAIG SCHULMAN

Dr. Craig T. Schulman’s economic analysis in the plaintiffs’ case, focusing on global real estate brokerage “rates” and other irrelevant factors, severely lacks academic rigor and fails to meet professional standards. His study, which should have encompassed nearly 200 countries and up to 36 economic factors, presumably could not identify any credible foreign market comparisons to support allegations of excessive fees imposed in the US.

BASELINE FOR RELEVANT ECONOMIC ANALYSIS

In analyzing the average commission costs for sellers across different international markets, it’s essential first to consider the average home values within each market and the implications of currency conversion. These key factors should precede an examination of the next ten variables.

- Commission Structures: Analyze US vs. global real estate agent commission structures, including fixed fees vs. sale percentage and actual fee values.

- Closing Costs: Compare US and international closing costs, including title search, insurance, legal fees, and administrative costs.

- Mortgage Interest Rates: Examine average mortgage rates in the US vs. other countries, considering loan terms, rate types, and economic influences.

- Property Taxation: Investigate global property tax rates and assessment methods and their impact on property ownership costs.

- Stamp Duty/Transfer Taxes: Assess the presence and rates of stamp duty or land transfer taxes in various countries and their transactional impact.

- Legal Fees in Transactions: Compare legal fees for property buying/selling across countries, including the role and cost of legal professionals.

- Mortgage Application/Processing Fees: Evaluate mortgage-related fees globally, including origination, application, and underwriting fees.

- Home Insurance Premiums: Analyze home insurance costs worldwide, factoring in location, property type, and coverage options.

- Capital Gains Tax on Sales: Compare capital gains tax on property sales between countries, including available exemptions and reliefs.

- Foreign Buyer Surcharges/Restrictions: Assess the impact of additional costs and restrictions on foreign buyers in various countries.

Rather than meeting the ethical obligation to offer truthful and unbiased information, Schulman appears to have selectively chosen metrics that favor The National Association of Realtors, leading to the portrayal of Australia as a comparable market.

COMPARATIVE ANALYSIS OF TRANSACTION COSTS: US VS. AUSTRALIA

Transacting In Australia

- The average home value in Australia, converted to USD, is $760,221.

- Selling costs include a 3% commission fee amounting to $22,806.

- Sellers typically face capital gains taxes averaging $52,000 in 2022.

- When sellers become buyers, they are liable for a 4% stamp duty tax estimated at $30,408. (10% when acquiring new construction)

- The total cost for a two-sided real estate transaction in Australia is approximately $105,214.

When scrutinizing the often-cited claim that real estate commission fees are higher in the US compared to Australia, a critical examination of specific market values reveals a different narrative. For instance, the median property value in Joplin, MO, which stood at $129,100 in 2021. With a standard 6% commission, Joplin-based agents would earn $7,746. To match the net fee of $22,806 that Australian agents typically earn from selling residences of average value, agents in Joplin would need to charge an exorbitant commission rate of 18%, amounting to $23,238. This stark comparison underscores the disparity in market dynamics and challenges the blanket assertion of higher US fees.

A revealing opinion piece published on July 7, 2023, titled “House Prices to Rise as Stamp Duty Forces Owners to Stay Put,” published months before trial, concludes in the relevant part: “A combination of steeply rising agent fees and stamp duties. This increase in costs is not just marginal but alarmingly disproportionate to income growth. Over the past two decades, the cost of acquiring a property – encompassing stamp duty, agent fees, solicitor fees, and listing costs – has skyrocketed, increasing five times faster than income. This startling statistic underscores a growing disconnect between real estate expenses and the financial realities of average Australians. The situation in Sydney exemplifies the severity of this issue. According to Carlos Cacho, Jarden’s chief economist, “transaction costs for an average home in Sydney have ballooned from $20,000 in 2000 to a staggering $100,000.”

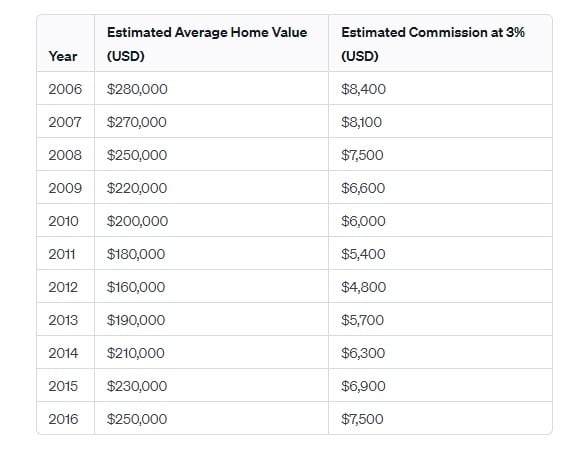

SCHULMAN’S CLAIM: RATES ARE IMPERVIOUS TO MARKET FLUCTUATIONS

Schulman argues that a key indicator of price fixing is when income does not respond to market changes. Yet, when applying the dollar cost approach, it becomes evident that the real estate sector experiences considerable volatility in market income, possibly more than any other industry segment.

DR. SCHULMAN, PROF OF ECONOMICS | TEXAS A&M | BERKELEY RESEARCH GROUP

When Schulman is not engaged in “findings for fees,” Schulman is a professor. On January 16, 2023, Dr. Schulman, a professor in the Economics Department at Texas A&M University, published Lecture Notes for Econometrics 461. Schulman’s instructions to his students include hundreds of pages and apply “dollars/actual costs” v. “percentages/rates” considerations when comparing global oil pricing. Oil companies are believed to have paid for Schulman’s global oil market analysis. Schulman’s expert methodology appears to vary based on the party providing Schulman’s enrichment. In our assessment, in a scenario where Dr. Craig Schulman was a student and enrolled in Professor Schulman’s Econometrics 461 class, student Schulman would fail Professor Schullman’s class if student Schulman attempted to apply the same embarrassingly unacademic methodologies allowed in Sitzer/Burnett.

STEPHEN BROBECK | CHIEF PROPAGANDIST | ANTI-LEGACY AGENT CARTEL

Stephen Brobeck critiques traditional real estate agents disseminating propaganda through platforms like Inman News. His studies, which span over six years, are mired in contradictions that undermine his credibility. He has argued that US agents charge exorbitantly high fees compared to international counterparts, allegedly causing up to $50 billion in consumer damages. Subsequent studies suggest that many Realtors struggle to make a minimum wage of $25,000 annually. This dichotomy in his assertions creates a puzzling narrative.

STEPHEN BROBECK | UNDERMINES KEY CLAIMS

In 2021, Stephen Brobeck’s study, “CFA PREDICTS IMPACT ON CONSUMERS AND REAL ESTATE BROKERS IF COURTS REQUIRE UNCOUPLED COMMISSIONS,” ironically supports the current commission structure under the guise of criticism. Brobeck’s assertion that mortgage lenders and GSEs would finance buyer broker commissions inadvertently admits that these fees are essential and already integrated into home sale prices. His claim that loan sizes would not change substantially implies buyers lower their offers to balance out commissions, maintaining loan sizes. Furthermore, his speculative stance that lenders would readily adapt to financing buyer broker commissions is dangerously unfounded.

Even though it has been over 1,064 days since the narrative’s inception, the lack of written confirmation from lenders and GSEs undermines the credibility of his theory. It risks profound implications for FHA and VA loan programs.

Natalya Delcoure & Norm G. Miller | 2002 Findings

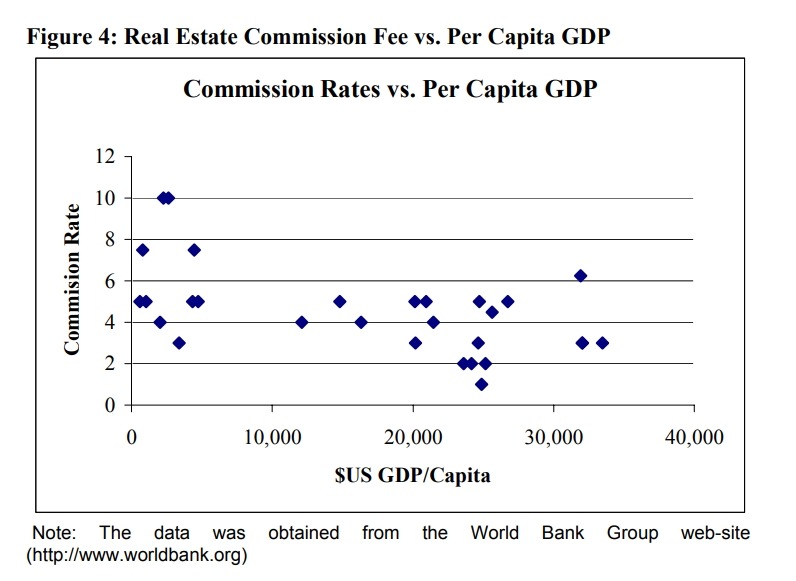

Delcoure and Miller’s study, “International Residential Real Estate Brokerage Fees and Implications for the US Brokerage Industry,” frequently referenced in various lawsuits, is notably outdated, having been published in 2002 before the advent of Redfin, Zillow, and Google Chrome. The study’s findings, often selectively cited, display inconsistencies and contradictions that do not align with the plaintiffs’ arguments. For instance, the following chart was initially titled “Real Estate Commission Fee vs. Per Capita GDP,” then was abruptly renamed “Commission Rates vs. Per Capita GDP.” The analysis of fees and rates leads to fatally flawed academic findings. Moreover, the study presents the actual dollar figures for GDP but curiously omits the actual dollar amounts in fees, opting for vague, generalized rates instead.

Acknowledgment | Empirical Models | Distirbingly Unaccademic

Again, conflating “fees” with “percentages” in real estate is not just misleading; it’s a blatant distortion of key financial terms. A “fee” is an actual monetary expense, while a “percentage” is one of many factors that can establish a fee, however entirely defective, as a sole consideration. Blurring these definitions is a disingenuous attempt to obscure financial realities in real estate transactions.

PLAINTIFF’S COUNSEL | CONSUMERS LACK COMPETENCE

The plaintiffs’ counsel’s assertion that residential real estate buyers lack competence due to infrequent purchases is not just far-fetched; it’s condescending and fundamentally flawed. Labeling buyers ignorant because they may buy a home only every eight years grossly underestimates consumer intelligence. It overlooks the fact that the vast majority of these buyers are not first-timers. Approximately 85% of the market comprises buyers making their second or subsequent purchase, individuals who have already navigated the complexities of selling a property. During these previous and likely recent transactions, they would have engaged directly with commission structures through listing agreements, gaining a significant understanding of commission variables.

UNCONSCIONABLE | REAL ESTATE COMMISSION CONCEALMENT

The plaintiff’s law firms’ critique of MLS systems for hiding commission details reeks of hypocrisy. While lambasting real estate agents for alleged commission-based steering, these firms conspicuously fail to display their fee structures on their websites. This glaring omission belies their calls for transparency and undercuts their credibility. Furthermore, the involvement of Stephen Brobeck from The Consumer Federation, an advocate for fee disclosure, adds to the irony. The Federation’s Form 990 lacks the clarity one would expect from a proponent of openness. This double standard weakens the plaintiff’s law firms’ stance and exposes a troubling inconsistency in their ethical advocacy. Presumably, consumers discover fees by inquiring, akin to legal fees.

ADVERSARIAL TRANSACTIONS | ANTITRUST ALLEGATIONS

To satisfy antitrust allegations, Plaintiffs must convince jurors that the goal of buyers, sellers, and associated agents is an adversarial zero-sum transaction. Plaintiffs claim there is no pro-completive value for sellers to contribute to fees imposed on buyers. Redfin strenuously disagrees, publishing, “Home sellers gave concessions to buyers in 45.5% of home sales recorded by Redfin agents during the three months ending February 28, up from 31.1% one year earlier. That’s the highest share of any three-month period in Redfin’s records, which date back to June 2020.” Moreover, Dr. Shulman’s superior at Berkley Research Group participated in a Business Insider opinion published on June 26, 2023, titled “THE MULTIBILLION-DOLLAR LAWSUITS THAT COULD RADICALLY RESHAPE HOW WE BUY AND SELL HOMES FOREVER” Berkeley Research Group’s Managing Director David Eisenstadt suggests that since NAR doesn’t fix compensation to buyer-agents, proving harm to sellers is challenging. He posits that minimal seller contributions are effectively non-burdensome and that sellers might benefit from compensating buyer agents, as it attracts serious buyers. This perspective implies real estate transactions are cooperative, not combative.

EXPOSING ABSURDITY: THE OVERBLOWN ALLEGATIONS OF REAL ESTATE STEERING

In their zeal to diminish the reputation of buyers agents and invent steering schemes, the plaintiffs’ experts seem to be clutching at straws, hoping that at least one of their allegations sticks. Their conclusions are riddled with contradictions and lack academic rigor. They claim that buyer’s agents lack value because “BUYERS IDENTIFY THE HOME THEY WILL ACQUIRE BEFORE CONTACTING AN AGENT,” making claims that agents engage in massive steering utterly impossible. Please help us understand a scenario where a buyer has already determined which home to acquire. Yet, agents successfully convince buyers to acquire homes they have no interest in, resulting in unlawful enrichment.

Buyers’ ability to identify homes to acquire before contacting an agent is a direct benefit of MLS syndication to real estate portals. These portals, including Zillow, Realtor.com, and Redfin, amass a staggering 109,700,000 monthly visits. Furthermore, portals do not filter listings based on commissions; thus, claims of concealment and steering are fatally flawed.

Will Fried | Former Rex Homes Analyst | An Evolution Of Absurdity

A former REX executive, Will Fried, introduces a new steering method hypothesis. His recent study suggests that low-commission homes receive fewer page views on Redfin, implying agent manipulation as agents must loiter on Redfin, sharing listings offering superior commissions to the same buyers who can access sites like Redfin and select the home to acquire before contacting the agent.

Fried’s recent study erroneously references an op-ed I authored, implying my endorsement of its conclusions. Contrary to this implication, my op-ed argues that consumers enjoy extensive access to property listings. It posits that any agent who withholds information or refuses to facilitate property tours as requested by buyers would inevitably lead to those buyers seeking services from alternative agents, rendering steering impossible.

CLEAR COOPERATION POLICY | A FALLACY OF ANTI-COMPETITIVE PRACTICES

Private listing services tout supposed benefits and engage in practices that border on misleading and potentially violating legal statutes. Their promotion of “Testing the Market” as a strategy was described in detail by Forbes. Forbes highlights “Off-Market Listings: How They Help Sellers” and “Testing the Market. YOU COULD DECIDE WITH YOUR AGENT TO PUT YOUR HOME ON A PRIVATE ONLINE NETWORK AS A TEST RUN, TO SEE WHETHER THE PRICE YOU SET GETS MUCH INTEREST. THE ADVANTAGE TO THIS APPROACH IS THAT IF YOUR PRICE IS TOO HIGH AND YOU’RE NOT GENERATING MUCH BUYER INTEREST, YOU CAN STOP THE PRIVATE LISTING AND MOVE TO THE MLS WITHOUT ANYONE KNOWING THE PRICE CHANGED AND THAT THE HOME ALREADY HAD BEEN ON THE MARKET. WHEN THE ENTIRE MLS CAN SEE THAT YOUR PRICE DROPPED AND THAT THE HOME HAS BEEN ON THE MARKET A WHILE, IT MIGHT EMBOLDEN BUYERS TO ASK FOR A PRICE CUT.”

This situation presents a starkly troubling scenario where sellers, their agents, private listing service websites, and their members seemingly try to deceive buyers by withholding essential information that influences pricing decisions. This tactic, aimed at preventing price reductions, represents a precise manipulation of market data. By allowing sellers to list and adjust prices privately without public disclosure, they effectively cloud critical information such as price history and time on the market, both essential for informed buyer decisions.

Such practices not only raise ethical questions but may also constitute a violation of Section 5 of the FTC Act, which explicitly forbids deceptive practices in commerce. Additionally, these actions starkly oppose state regulations like NRS 645.252, which mandates that real estate agents disclose all material facts about a property. By hiding details like price adjustments or how long a property has been on the market, these services directly violated their duty to provide full disclosure.

The irony of private listing services suing the National Association of Realtors (NAR) for antitrust violations while simultaneously seeking to engage in practices that appear to violate The Sherman Act. It is challenging to conceive that any reputable brokerage, particularly those committed to the NAR Code of Ethics, would participate in a system that deliberately withholds material information from buyers. Such a model, more suited to countries with lenient legal systems like Sommolia, is utterly inappropriate for operation in regulated environments like San Francisco.

NEFARIOUS | BLANKET OFFERS REGARDLESS OF BUYER-BROKER EXPERIENCE

The length of time an agent has been in the industry holds no significance in successfully conducting a property sale as per the seller’s specified price and terms. The agent’s ability to competently and effectively facilitate the transaction confirms the agent’s competency.

JURISDICTIONAL ADVANTAGE | ADJUDICATE AT DISTRICT COURT, WD MISSOURI

How is it possible to win a $5.35B award when a case lacks legitimate considerations? Adjudicate in Missouri. Missouri’s public sector is currently mired in a troubling quagmire of misconduct allegations, casting a long shadow over its governance and integrity. These accusations, ranging from corruption to ethical breaches, are a distressing picture of systemic misconduct.

The Center for Public Integrity agrees, rating Missouri as D-.

MICHAEL KETCHMARK | BURNETT | SITZER & GIBSON LEAD ATTORNEY

MICHAEL KETCHMARK is the chosen one. In the legal drama that unfolded in the Sitzer/Burnett case, Michael Ketchmark’s performance was nothing short of cinematic excellence, worthy of an Oscar. Although detailed descriptions of courtroom proceedings were never published, Ketchmark’s PR team at Inman did a great job sharing subjective highlights. Theatrical flair was on full display, even going so far as to invoke scripture in a scathing critique of Gary Keller’s remarks about the charitable efforts of KW Cares. Such dramatics suggest an almost supernatural ability to sway opinions, a talent that seems to border on mind control. The influence Ketchmark seemingly wielded over the decision-making process, particularly over Judge Bough and the jury, is a phenomenon that demands closer scrutiny.

Lack Of Enforcement | RULE 3.6: | PUBLIC STATEMENTS | TAINTING FUTURE JURIES

Rule 3.6 (a) clearly states that a lawyer involved in the investigation or litigation of a case should not make public statements outside the court that could materially prejudice an adjudicative proceeding. Despite this, Michael Ketchmark launched a wide-reaching media campaign, including a piece in the Daily Mail titled “Realtors face their reckoning: Class-action lawsuit seeks to recover more than $100 BILLION for home sellers who paid overinflated brokers’ fees- after landmark ruling left Missouri residents in-line for up to $20K EACH”. Ketchmark’s figures don’t add up. With an estimated 500,000 class members in Missouri, and assuming the total recovery of $5.35 billion, the maximum potential payout would be around $10,000 per person. After accounting for legal fees, this amount would be further reduced to approximately $6,000. Ketchmark’s claim that Missouri residents could receive up to $20,000 each significantly exaggerates the potential payouts and contradicts Rule 3.6.

This exaggeration leads to jurors falsely believing that joining Ketchmark’s lawsuit could yield a $20,000 reward. Ketchmark appears to transcend rules, including Rule 3.6.

The Ketchmark Cartel

Ketchmark is a known power player in Missouri. Michael Ketchmark and his firm have donated more than $1 million to Democrats and Republicans over the past decade. Ketchmark’s brother is believed to be David Ketchmark, former US Attorney of Missouri, whose spouse is Judge Roseann A. Ketchmark. Judge Ketchmark is assigned to courtroom eight, and courtroom seven is assigned to Judge Stephen R. Bough.

Political Action Committee Associations (alleged)

-Committee For Liberty

-Life And Liberty PAC

-Uniting Missouri

-Don’t Tread On Missouri PAC

-Defend MissoUSi PAC

-Excelsior

–Taxpayers Ulimited Inc

Campaign Contributions | Current Office Holders

-Governor Parson

-AG Bailey

-SOS Aschcorft

-Auditor Fitzpatrick

–Councilmember Andrea Bough

Although Ketchmark and alleged affiliated PACs generously contribute to various campaigns, we will focus on the Kansas City, 6th District-at-Large, and Taxpayers Unlimited Inc.

Councilmember Andrea Bough (6th District-at-Large) was elected in 2019 and re-elected in 2023. Councilmember Andrea Bough is the spouse of Sitzer’s presiding Judge, Stephen Brough. Judge Bough is believed to be t a current member of the Board of Trustees at UMKC Law Foundation.

Ketchmark, an alleged significant contributor to Taxpayers Unlimited Inc., and Sitzer’s Plaintiff’s attorney, Mathew Dameron, declined to provide a single contribution to Councilmember Andrea Bough’s 2019 campaign. Upon Judge Bough’s assignment to Sitzer, Taxpayers Unlimited Inc. and Mathew Dameron, in a personal capacity, subsequently provided campaign contributions on up to seven occasions, even in non-election years.

JUDGE STEPHEN R. BOUGH | BURNETT | SITZER & GIBSON

Judge Stephen Bough, the United States District Judge for the Western District of Missouri, is a former Chairman of the Jackson County Democratic Committee. Appointed by President Obama and confirmed despite concerns voiced by Republican Senator Chuck Grassley, Bough’s political affiliations and history of donations to the Democratic Party have been a contention. Ranking member Grassley stated, “The nominee has shown in other contexts that he is, first and foremost, a political operative rather than a zealous advocate for a client or an officer of the court.”

REQUIRED TO RECUSE

Judicial recusal is vital for maintaining judicial integrity and fairness. Judges must recuse themselves in cases of:

- Personal Bias or Prejudice:

- Financial Interest: Any personal financial interest in the case outcome.

- Personal Relationships: Close connections with parties, attorneys, or witnesses.

- Preconceived Opinions: Publicly expressed opinions or previous rulings on related matters.

- Prior Involvement: Participation in the case as an attorney, witness, or similar roles.

- Appearance of Impropriety:

- Conflicts of Interest: Perceptions of conflict, including political, social, or organizational ties.

- Public Perception: Potential decision-making questioning due to community, media, or public scrutiny.

- Other Ethical Concerns: Any situation that could reasonably question the judge’s integrity or impartiality.

Conclusion

These lawsuits represent a deeply troubling and ethically dubious trajectory. The apparent collusion among prop-tech firms, certain media outlets, and so-called expert studies are not just suspect but reeks of a concerted effort to manipulate legal outcomes. This orchestrated effort seems to have unduly influenced the Department of Justice’s investigation, triggering a cascade of repetitive lawsuits across various jurisdictions. The fact that either President Obama or President Biden appointed all presiding judges in these cases raises serious questions about the potential bias and strategic selection of judges and jurisdictions. This orchestrated legal strategy, aimed at extracting an astronomical $100 billion in damages from around 182 named defendants, is nothing short of a legal travesty. The requirement for each defendant to fork out a $10,000 retainer merely to respond imposes an exorbitant collective initial cost of $1,820,000, which increases exponentially to adjudicate. This strategy, which borders on legal extortion, is egregiously unethical, even by the standards of contingency-based law firms, reflecting a blatant abuse of the legal system for opportunistic financial gain.

A deluge of state, federal, and ethics complaints are being drafted to the plaintiff’s counsel. This bullshit ends now.

Author Anthony Phillips

Anthony Phillips, co-founder of Luxury Real Estate Advisors, is renowned in the Las Vegas luxury real estate market, providing top-tier services to global clients, including private equity firms. In addition to leading 12 Las Vegas HOA Boards, his performance at premier locations earned him a spot in MGM Resorts International’s Elite Developer Circle.

Phillips continually enhances his expertise through Executive Education programs at Cornell University and MIT. He hails from the influential Phillips family of New England and Missouri, known for their varied contributions to law, academia, business, politics, national defense, intelligence, and consumer rights.