Information Reliable But Not Guaranteed. Retain The Appropriate Tax And Legal Professionals.

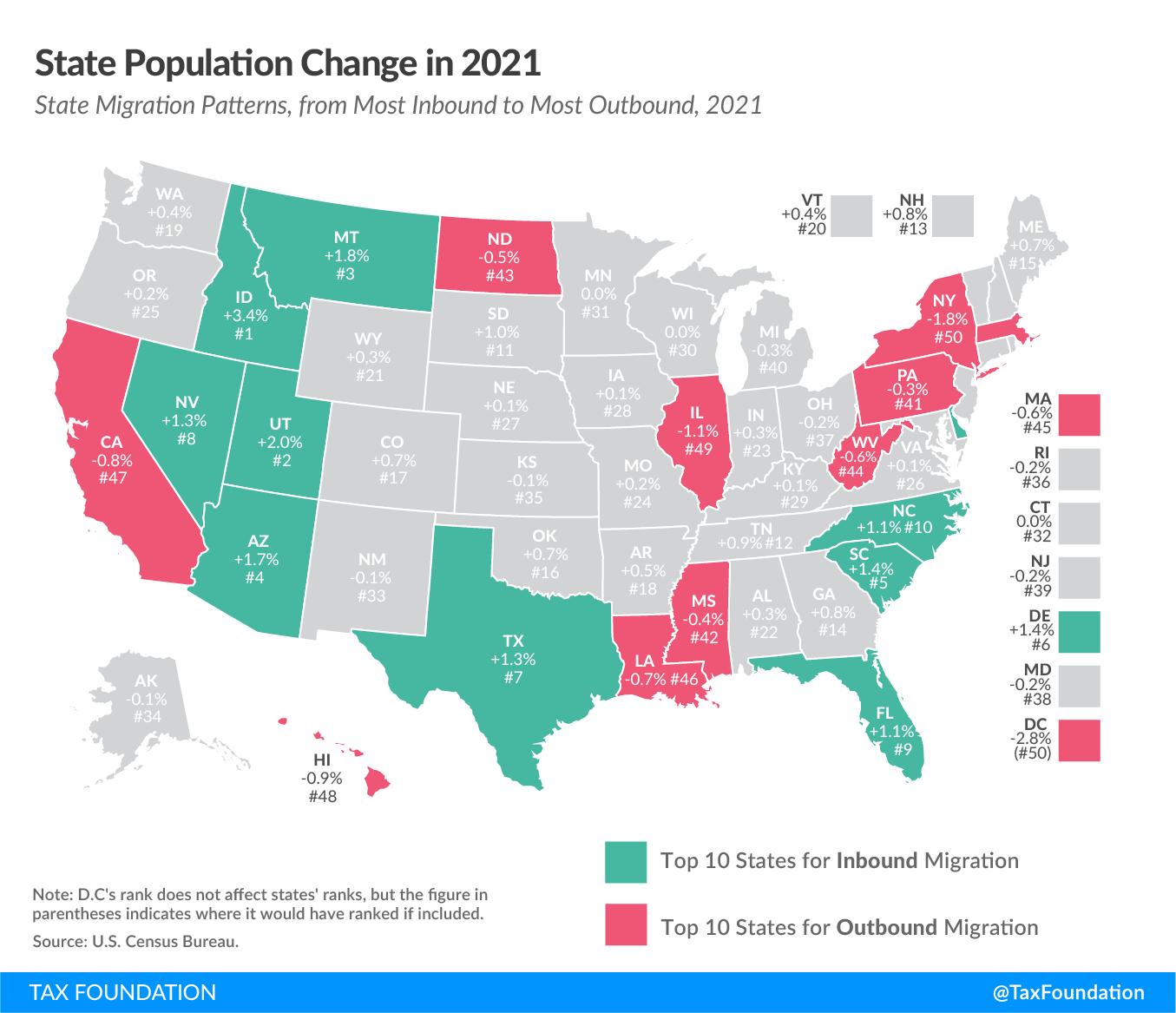

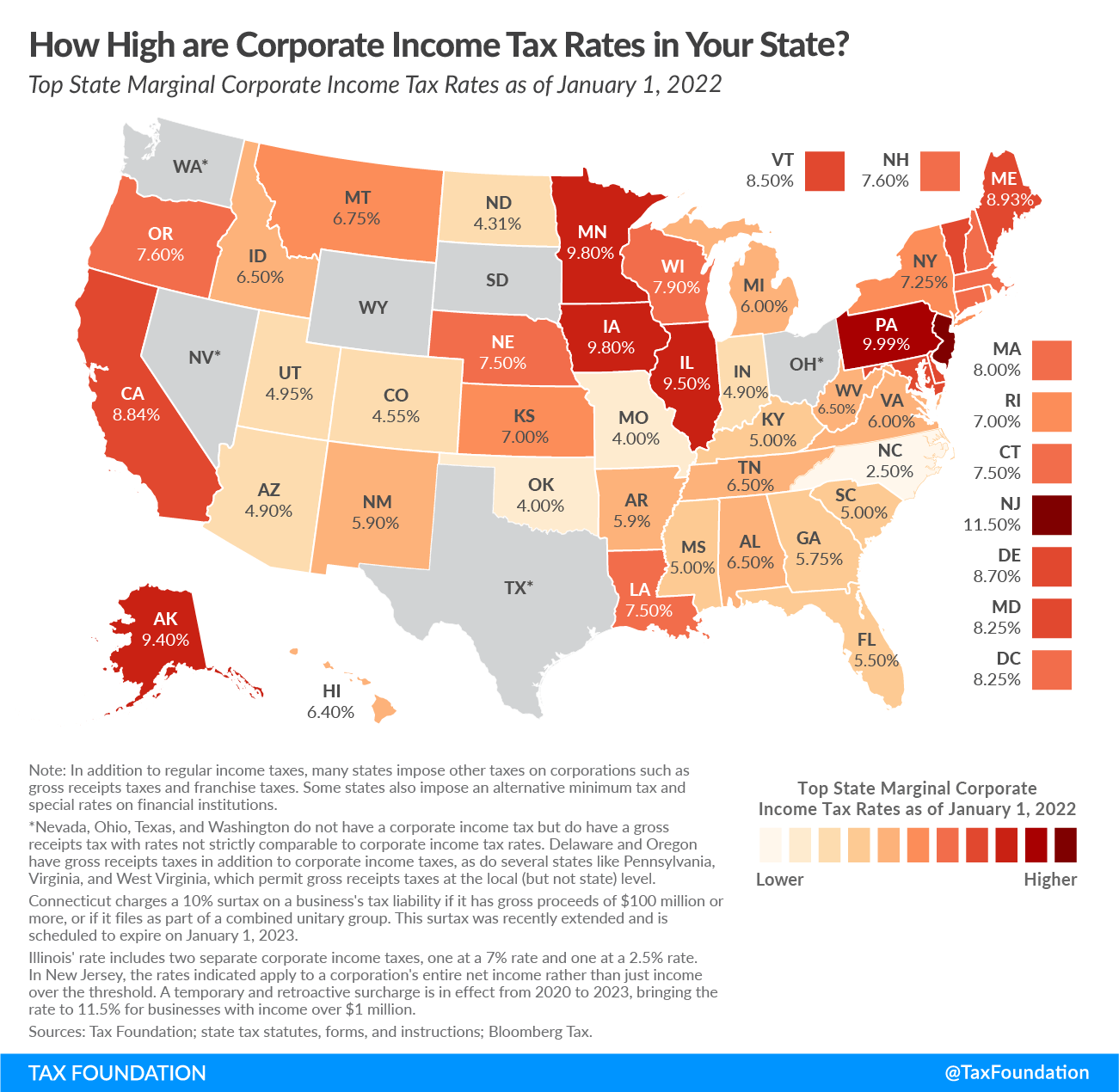

Reasons why you should consider Nevada for your home and business:

- No personal income tax

- No corporate income tax

- No gross receipts tax

- No franchise tax

- No inventory tax

- No tax on issuance of corporate shares

- No tax on sale or transfer of shares

- No succession or inheritance with IRS

- Protection for Directors and Officers

- Business-friendly environment

Reasons to consider Nevada when buying investment properties:

- Favorable capitalization rates

- No rent controls

- No landlord paid tenant relocation assistance

- No periodic city inspections

- Landlord friendly eviction laws

Contact us for Las Vegas relocation assistance.

*Luxury Real Estate Advisors agents are not tax attorneys or CPAs. We strongly recommend that you consult your tax adviser to address your specific situation.